Plan Your Financial Future with Expert Guidance

In today's complex financial landscape, our expert advisors are here to help you navigate the uncertainties and design a customized plan that aligns with your unique financial goals and aspirations.

What we do

Ethical and Fiduciary Responsibility

As fiduciaries, we hold ourselves to the highest ethical standards. Your financial interests always come first, and we are dedicated to providing you with unbiased advice that is solely in your best interest. You can trust us to act with integrity and professionalism.

Good Approach

Great Ideas

Save Money

Detailed Report

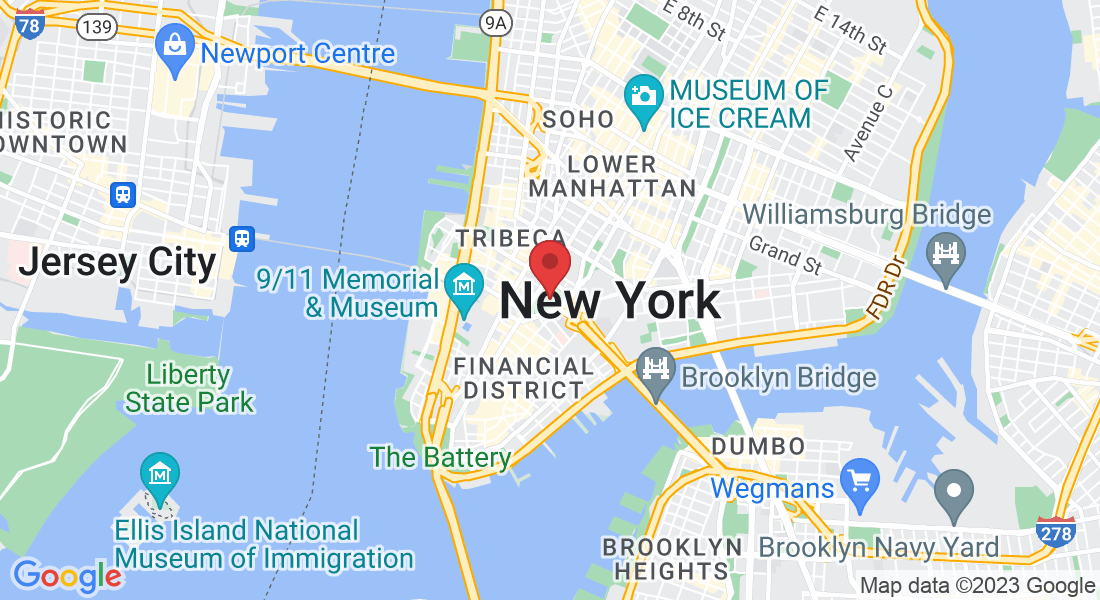

Around-the-Clock Financial Guidance

At [Your Company Name], we understand that financial questions and concerns don't adhere to a 9-to-5 schedule. That's why our 24/7 financial advisory services are always available to you. Whether you have a pressing financial issue in the middle of the night or need guidance during the weekend, our team of expert advisors is here to assist you at any time.

Comprehensive Financial Planning

Highlight your comprehensive financial planning services, which involve a holistic assessment of a client's financial situation. Describe how you work closely with clients to set financial goals, create personalized financial plans, and provide ongoing guidance to help them achieve their objectives. Mention areas you cover, such as retirement planning, investment management, tax planning, and estate planning.

Investment Management

Promote your investment management services, where you assist clients in building and managing investment portfolios aligned with their financial goals and risk tolerance. Explain your approach to asset allocation, portfolio diversification, and investment strategies tailored to individual needs.

Retirement Planning

Emphasize your retirement planning services. Describe how you help clients plan for a secure and comfortable retirement by assessing their retirement goals, estimating retirement income needs, and creating strategies for retirement savings and withdrawals. Highlight your expertise in optimizing retirement accounts, such as 401(k)s and IRAs.

Estate Planning and Wealth Transfer

Showcase your estate planning and wealth transfer services. Explain how you assist clients in preserving and transferring their wealth efficiently to heirs and beneficiaries while minimizing estate taxes. Describe strategies for creating wills, trusts, and legacy plans tailored to their unique circumstances.

Our Team

JOHN DOE

JOHN DOE

JOHN DOE

FAQS

What is the benefit of working with a financial advisor?

Working with a financial advisor offers numerous benefits. First and foremost, advisors provide expertise and guidance tailored to your unique financial situation and goals. They can help you create a comprehensive financial plan, optimize your investments, minimize taxes, and ensure you're on track to achieve your financial objectives. Additionally, advisors offer peace of mind, knowing that you have a professional managing your financial affairs and helping you make informed decisions.

How do I choose the right financial advisor for my needs?

Choosing the right financial advisor is a critical decision. Start by assessing your own financial goals and preferences. Look for advisors with the appropriate qualifications and certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Consider their experience, specialization, and track record. It's also important to have a consultation or interview to ensure their approach aligns with your values and objectives. Lastly, check for transparency in fees and compensation to avoid surprises.

Do I need a large portfolio to benefit from financial advisor services?

No, you don't need a large portfolio to benefit from financial advisor services. Financial advisors can assist individuals at various stages of their financial journey, from those just starting to save to those with substantial assets. Advisors can help you create a financial plan, manage debt, set up an emergency fund, and make the most of your resources, regardless of your current wealth. Their goal is to help you improve your financial well-being and work towards your financial goals, whatever they may be.

What Are Our Customers Saying ?

Feedback from our delighted clientele.

I can't thank [Your Company Name] enough for their unwavering support and expert guidance. When my husband and I faced a sudden financial crisis, we didn't know where to turn. They were there for us, day and night, helping us make sound decisions.

JANE DOE

I've been a client of [Your Company Name] for years, and I can confidently say they've transformed my financial outlook. Their 24/7 services have allowed me to seize investment opportunities at the right moment and navigate market turbulence with ease.

JANE DOE